Book A Free,

No-Obligation Call

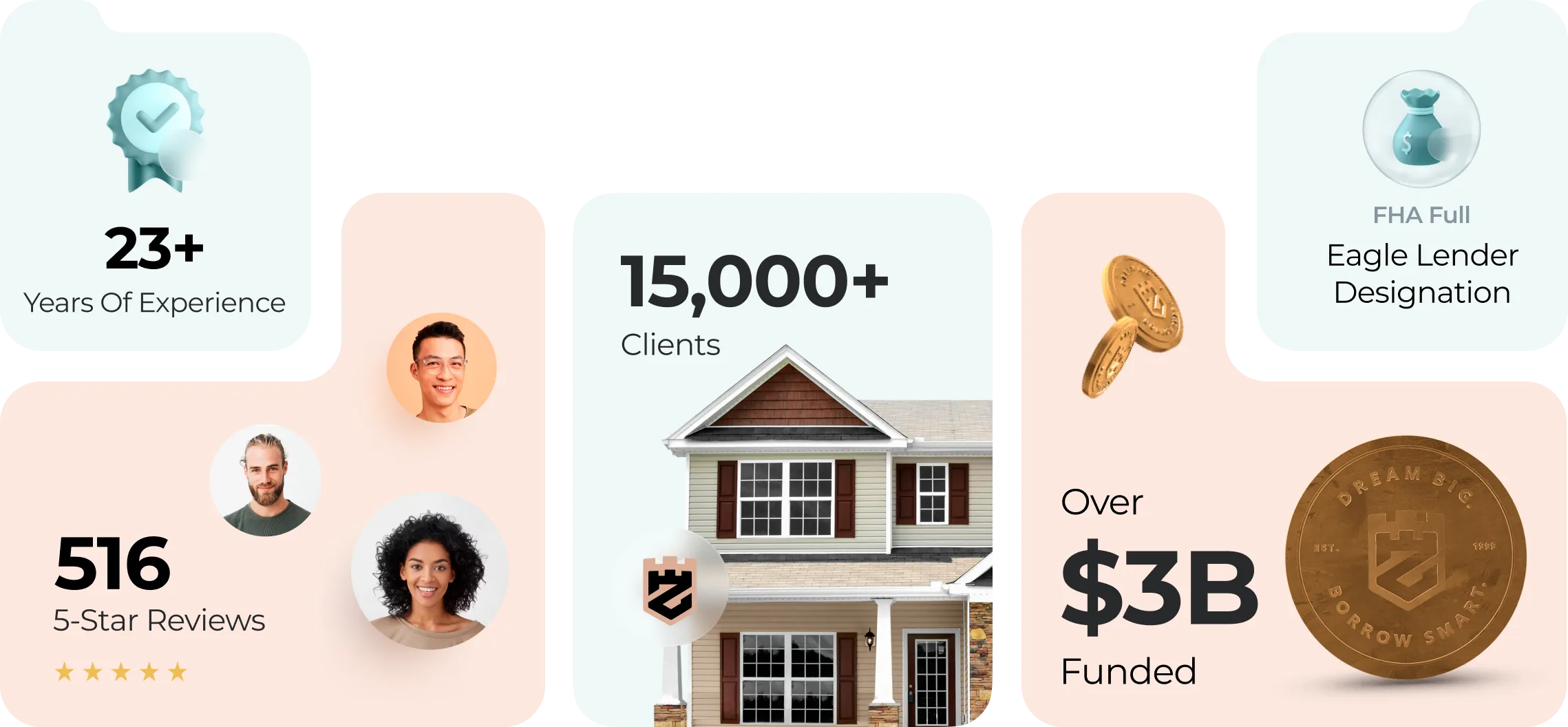

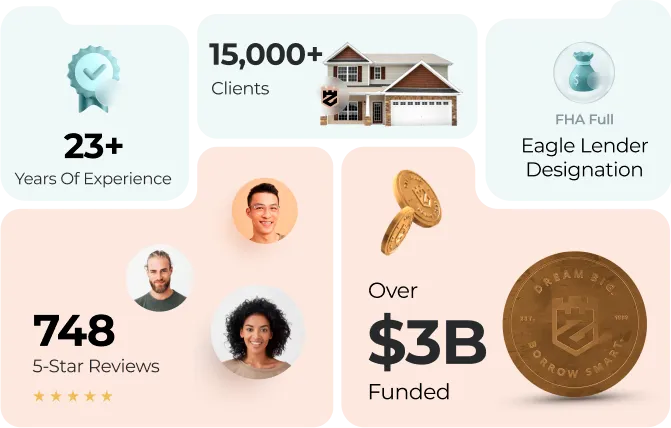

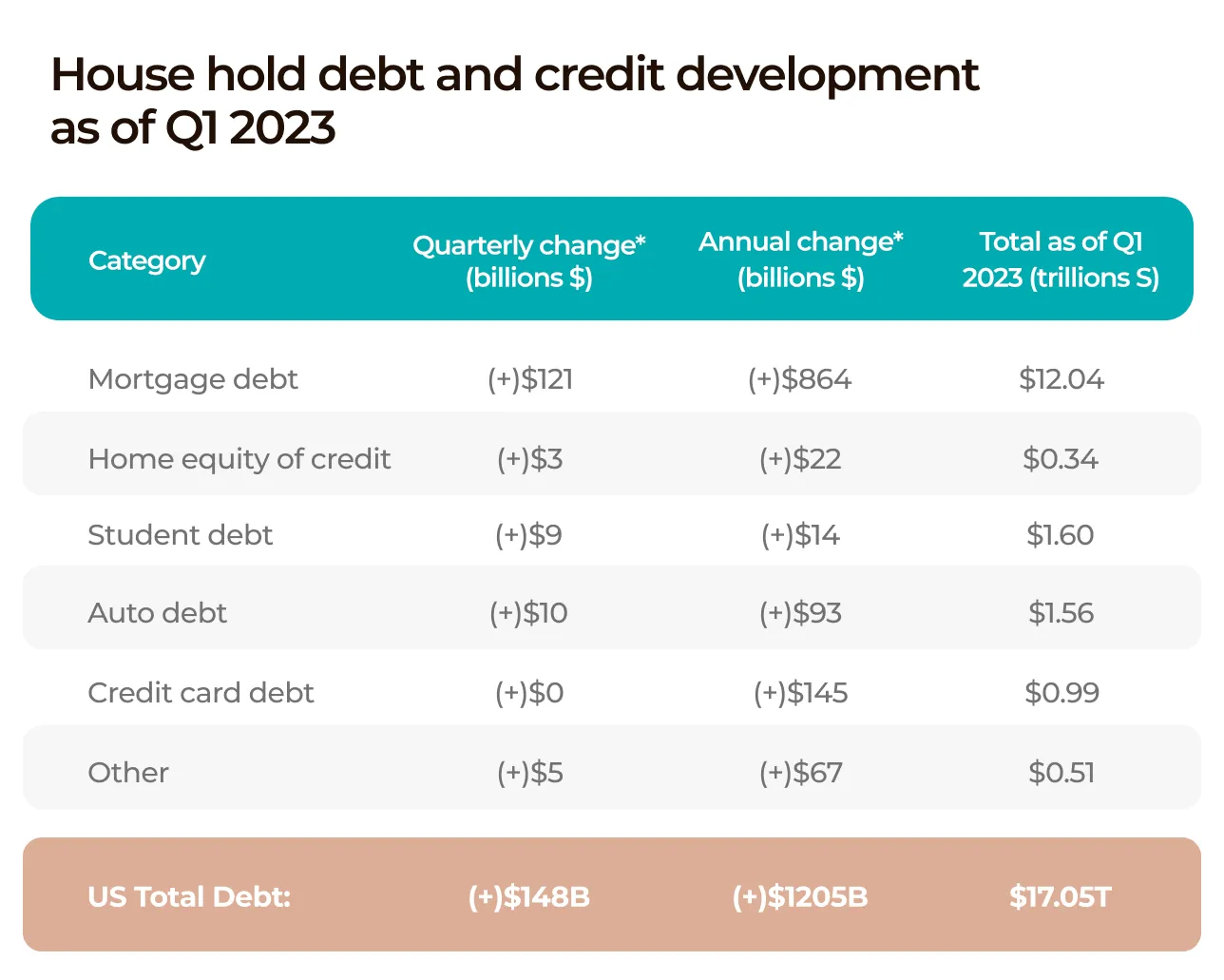

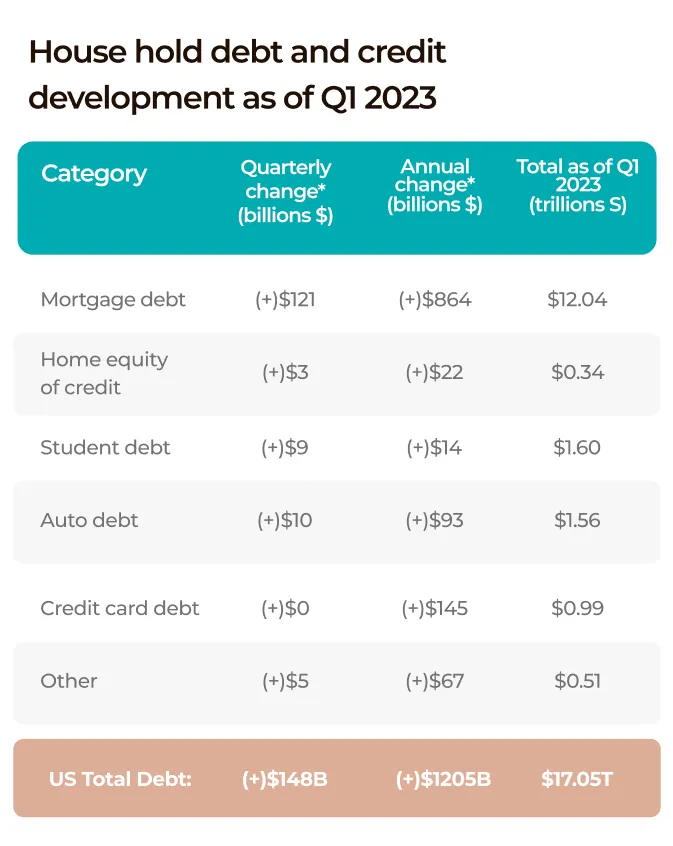

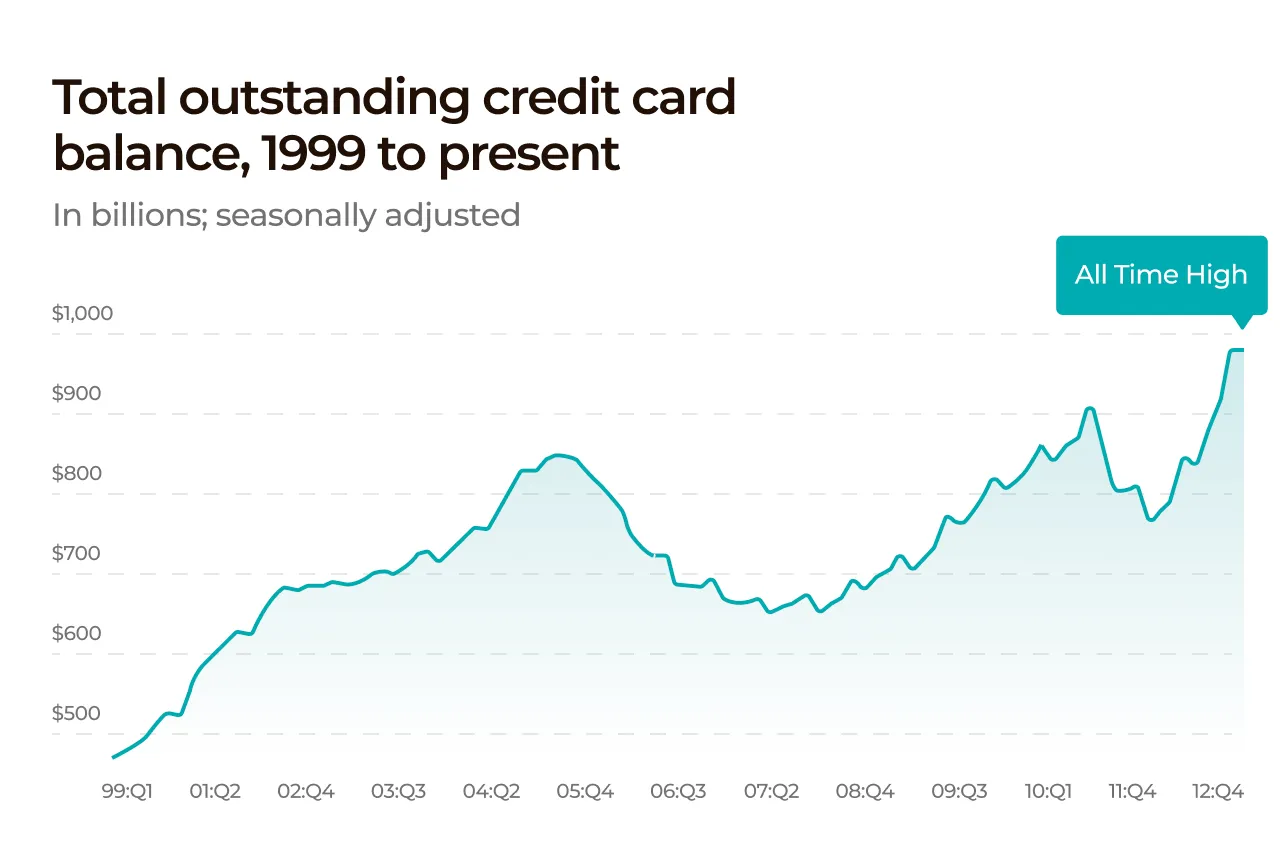

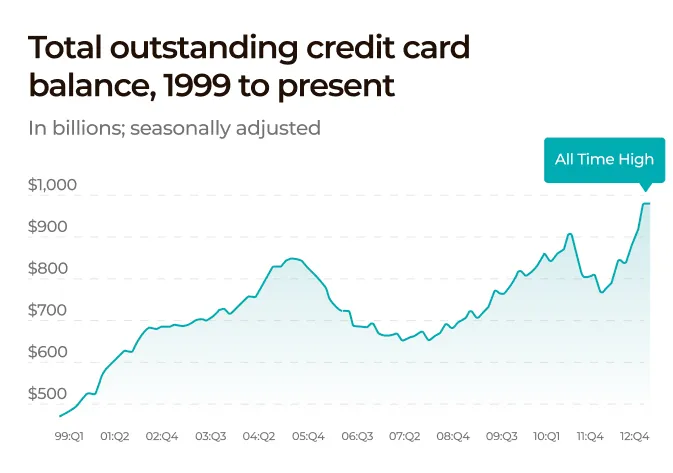

Book a ‘Cashflow Analysis Call’ with one of our experts to discuss your current financial position. You’ll walk away with a tailored plan to increase your cashflow without landing yourself in crippling debt.